Empowering Women in the Cryptocurrency Realm: Prema Chuttoo’s Educational Series for Womenlines Readers, sharing today about cryptocurrency security. Prema Chuttoo is a SAP Technical Consultant from Belgium and is a guest contributor at Womenlines.com.

Smart contracts can be defined as self-executing agreements written in code and stored on blockchain technology. Unlike traditional contracts, which require manual enforcement and oversight, smart contracts automate the execution of actions based on predefined conditions.

Blockchain Technology

What are its key characteristics:

- Decentralization: Smart contracts operate on a decentralized network, such as a blockchain, removing the need for a central authority or intermediary to oversee the agreement.

- Immutability: Once deployed, the code of a smart contract cannot be altered or tampered with, ensuring the integrity and reliability of the agreement.

- Self-verifying and Self-enforcing: Smart contracts verify the fulfillment of conditions automatically and execute the agreed-upon actions without relying on external parties. This reduces the risk of fraud or manipulation.

The following are the components of Smart Contracts:

Contract Code: Smart contracts are created using programming languages specifically designed for writing contract logic, such as Solidity for Ethereum. The code defines the terms, conditions, and actions to be executed when certain conditions are met.

Data Storage: Smart contracts store data on the blockchain, ensuring transparency and security. The decentralized nature of blockchain technology eliminates the risk of a single point of failure or data manipulation.

External Triggers: Smart contracts can interact with external systems or oracles to obtain real-world data necessary for their execution. Oracles act as bridges between the blockchain and external sources, providing reliable information to the smart contract.

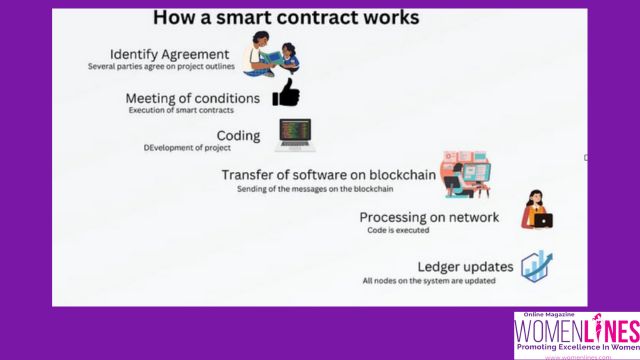

Execution Process of Smart Contracts

Deployment: Smart contracts are deployed onto a blockchain network through a transaction. Users pay a gas fee, representing the computational resources required to execute the contract and record it on the blockchain.

Triggering Conditions: Smart contracts have predefined conditions written into their code. These conditions typically involve if-then logic, specifying when certain actions should be triggered based on the fulfillment of specific criteria.

Automatic Execution: Once the triggering conditions are met, the smart contract autonomously executes the predetermined actions without the need for manual intervention. Consensus mechanisms within the blockchain network validate and verify the execution to ensure its accuracy and consistency.

Advantages and Potential Applications of Smart Contracts

- Efficiency: Smart contracts automate processes, eliminating the need for intermediaries and manual intervention. This leads to increased efficiency, faster transaction times, and reduced costs.

- Security: Smart contracts are secure due to their immutability and cryptographic nature. Once recorded on the blockchain, the contract cannot be tampered with, ensuring the integrity of the agreement.

Smart contracts have the potential to transform various industries and sectors:

- Finance: Smart contracts can automate payment processing, peer-to-peer lending, and financial agreements.

- Supply Chain Management: Smart contracts can streamline supply chain operations, tracking the movement of goods, verifying authenticity, and automating payment settlements.

- Healthcare: Smart contracts can enhance patient data management, automate insurance claims, and facilitate secure sharing of medical records.

- Intellectual Property: Smart contracts can automate the management and licensing of intellectual property, ensuring transparent and fair distribution of royalties.

An example of a smart contract is discussed as follows:

One example of a smart contract is a decentralized lending platform built on the Ethereum blockchain called “Compound.” Compound allows users to lend and borrow cryptocurrencies without the need for intermediaries like banks or lending institutions.

In this smart contract example, let’s consider a user who wants to lend their Ethereum (ETH) to earn interest. Here’s how the smart contract would work:

Deployment: The Compound smart contract is deployed on the Ethereum blockchain. It contains the necessary code and functions to facilitate lending and borrowing.

User Interaction: The user interacts with the smart contract through a decentralized application (dApp) interface. They connect their Ethereum wallet to the dApp, which interacts with the smart contract on their behalf.

Deposit: The user specifies the amount of Ethereum they want to lend and initiates a deposit transaction through the dApp. The smart contract verifies the user’s balance and reserves the specified amount for lending.

Interest Calculation: The smart contract calculates the interest earned based on the supply and demand dynamics of the lending pool. The interest rate is determined algorithmically, considering factors such as the utilization rate of the borrowed funds.

Distribution of Interest: At regular intervals, the smart contract distributes the earned interest to the user’s wallet. The interest is automatically calculated and transferred based on the user’s share of the lending pool.

Withdrawal: If the user wants to withdraw their deposited Ethereum, they initiate a withdrawal transaction through the dApp. The smart contract verifies the availability of the funds and transfers the specified amount back to the user’s wallet.

Borrowing: On the other side of the lending platform, borrowers can access funds by posting collateral in another cryptocurrency, such as Wrapped Bitcoin (WBTC). They can borrow a certain amount of Ethereum based on the value of their collateral, and they need to repay the borrowed amount along with accrued interest within a specified period.

Throughout this process, the smart contract autonomously handles the verification, allocation, calculation, and distribution of funds. It ensures that lenders receive their earned interest and borrowers fulfill their repayment obligations.

This example illustrates how a smart contract like Compound can facilitate peer-to-peer lending without the need for a centralized intermediary. The transparency and automation provided by the smart contract enhance the efficiency, security, and accessibility of the lending process, offering a decentralized alternative to traditional lending systems.

By understanding how smart contracts work, from their decentralized and immutable nature to their automatic execution based on predefined conditions, individuals and businesses can harness the transformative potential of this technology. Smart contracts offer increased efficiency, transparency, and trust in global transactions, paving the way for a future where traditional agreements are replaced by automated, secure, and self-executing contracts on the blockchain.

Enjoy the educational part of crypto!

Prema Chuttoo

SAP Technical Consultant/Company Director/author

Belgium

Also read: Guarding Your Digital Vault: A Deep Dive into Cryptocurrency Security

Follow Womenlines on Social Media

Subscribe to Womenlines, the top-ranked online magazine for business, health, and leadership insights. Unleash your true potential with captivating content, and witness our expert content marketing services skyrocket your brand’s online visibility worldwide. Join us on this transformative journey to becoming your best self!

Subscribe to Womenlines, the top-ranked online magazine for business, health, and leadership insights. Unleash your true potential with captivating content, and witness our expert content marketing services skyrocket your brand’s online visibility worldwide. Join us on this transformative journey to becoming your best self!